We Started Small, Just Like You

Back in 2019, two accountants were sitting in a cramped office in Sydney, frustrated by how complex financial advice had become. We thought there had to be a better way to help Australian families understand their money.

Since 2019

How We Actually Got Here

Honestly, we didn't plan to build a financial education platform. We were just tired of seeing people make the same money mistakes over and over because nobody explained things clearly.

Started with a simple newsletter. Sixty-three subscribers in the first month—most of them were family members. But something clicked when people started replying, saying they finally understood superannuation or investment basics.

One email changed everything. A teacher from Newcastle wrote that our article helped her save fifteen thousand dollars on refinancing. That's when we realized clear financial information actually matters to real people.

So we kept going. Built this platform gradually, added courses when people asked for them, brought in specialists who could actually explain complex topics without the jargon. By early 2023, we had about two thousand regular readers across Australia.

Now we're working with small business owners, young professionals, retirees—anyone who wants to understand their finances without needing an economics degree. We still mess up sometimes. Still learning. But we're committed to keeping this real and accessible.

What Keeps Us Going

We're not perfect, and we won't pretend to be. But these principles guide how we work with every person who trusts us with their financial questions.

Plain Language First

Financial jargon exists because it makes some people feel smart. We think it just confuses everyone else. So we explain things the way you'd talk to a friend over coffee—clear, direct, no pretending.

Real Situations Only

Every example we use comes from actual client questions. We don't make up perfect scenarios. Australian tax laws change constantly, property markets shift, and life gets messy. Our advice reflects that reality.

Your Goals Matter

Not everyone wants to retire at fifty with millions in the bank. Some people just want to stop stressing about bills. We help with both—and everything in between—without judgment about what success should look like.

The People Behind quastralivex

Small team, diverse backgrounds. We argue about financial strategies sometimes, but that makes our insights better. Here's who you'll actually be learning from.

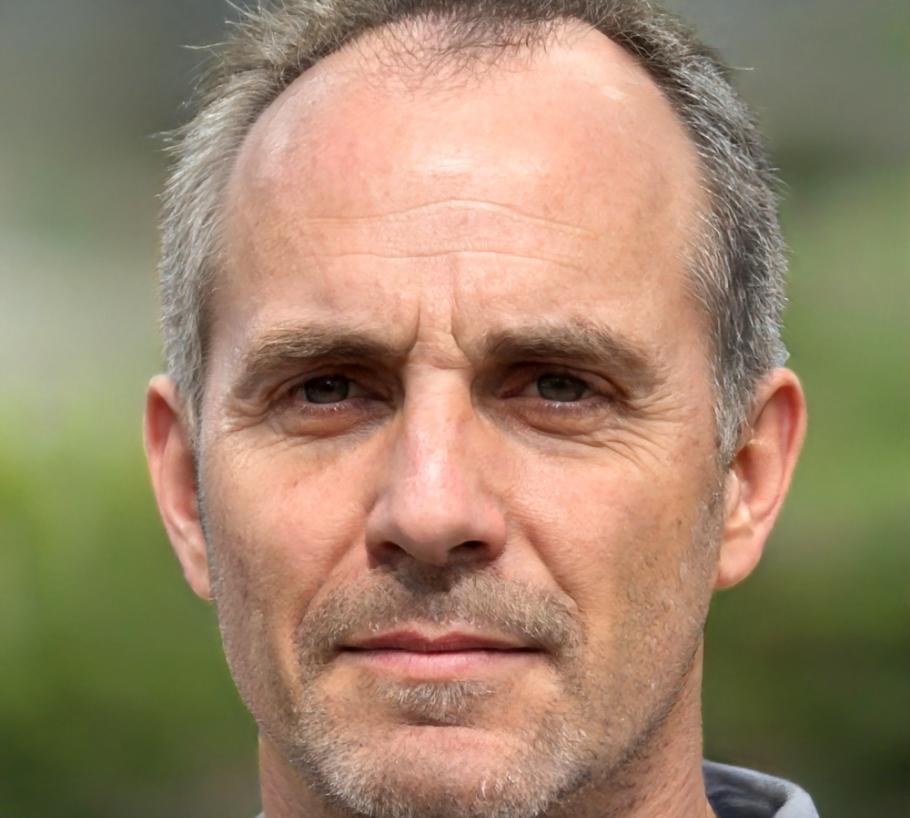

Kieran Blackwood

Spent twelve years in corporate finance before realizing he was better at explaining money than managing it. Builds most of our investment courses and has this weird talent for making tax strategies actually interesting. Lives in Melbourne with two rescue dogs.

Investment Planning & Tax Efficiency

Desmond Culhane

Former business journalist who got tired of writing fluff pieces. Now creates educational content that actually helps people understand budgeting and debt management. Occasionally writes too many words, but his explanations stick with you. Based in Brisbane.

Budgeting Frameworks & Debt Strategy